choosing a 529 college savings plan … 4 years later

Back when Miss L was six months old, we started her college savings fund. I posted and shared about the options available at that time as well as how we settled upon a 529 Plan. Now while I love sharing about things when they’re bright and shiny and new, I also realize how helpful it is to reflect on those decisions after we have the benefit of time and reflection… so that’s what I thought I’d do today!

Based on the information and availability of plans back in 2010, we opted to invest our money in the Utah Educational Savings Plan. We did so based on ratings from Bankrate’s Savingforcollege.com (comparison of all state plans), and using other resources comparing value and plan expenses. [It’s worth noting that California now has a 5-star plan of its own, Scholarshare, which actually gets slightly better ratings than Utah.]

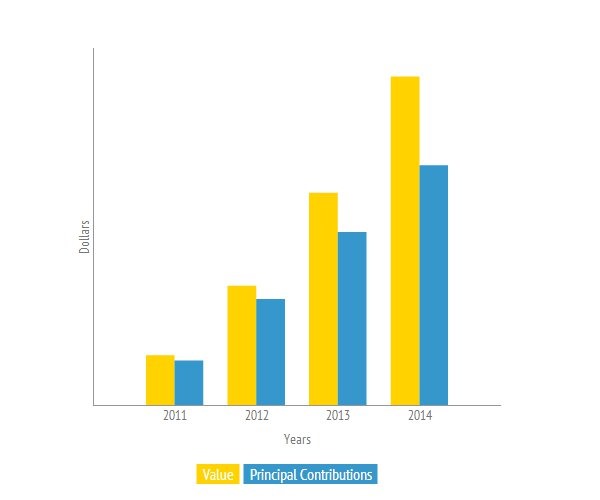

So after 4 years of consistent investing, what does that actually look like?

Currently, Miss L’s funds are valued at 137% of our net principal contribution. As you can see, we’ve invested the same amount every year (we have an automatic withdrawal from our checking account), but thanks to favorable market conditions, Miss L’s money is growing pretty nicely.

Here’s the annual breakdown:

- Year 1 = 111% of principal contributions

- Year 2 = 112% of principal contributions

- Year 3 = 123% of principal contributions

- Year 4 = 137% of principal contributions

As for costs, we’ve currently paid a total of 0.84% of our principal contributions over 4 years.

Are we happy with the decision thus far? Yes! We know that the rapid growth has come from the overall rapid growth of the funds in general, but it’s still nice to know that our investment is doing well when the market is doing well.

And as for early investing? It’s really nice to know that we’ve started this school fund and have it growing for whenever it’s needed. And it truly is “out of sight out of mind” until those quarterly statements show up! If we got a tax break for doing it, we’d be even happier, but oh well!

Will we hit the target expenses? Right now our current contributions say we’re on target to pay for 3 years of public tuition at the inflated rates. So no… we’re not at 4 years of full tuition. But when we can start contributing more monthly in the future, then we’ll hopefully catch up a little bit!

So here we are…4 years down and only 14 more to go! Ooooh boy!

Here are a few handy links f you’re looking to invest in a 529 plan:

3 Comments

Jackie

Great informative post! I don’t have human children yet, but am highly considering this!

Kate

You’re so responsible! We’re hoping our guy starts a lemonade stand soon.

Kat

Thanks! We just opened one in my state for our baby and I appreciate the perspective.